Press Kit

TL;DR

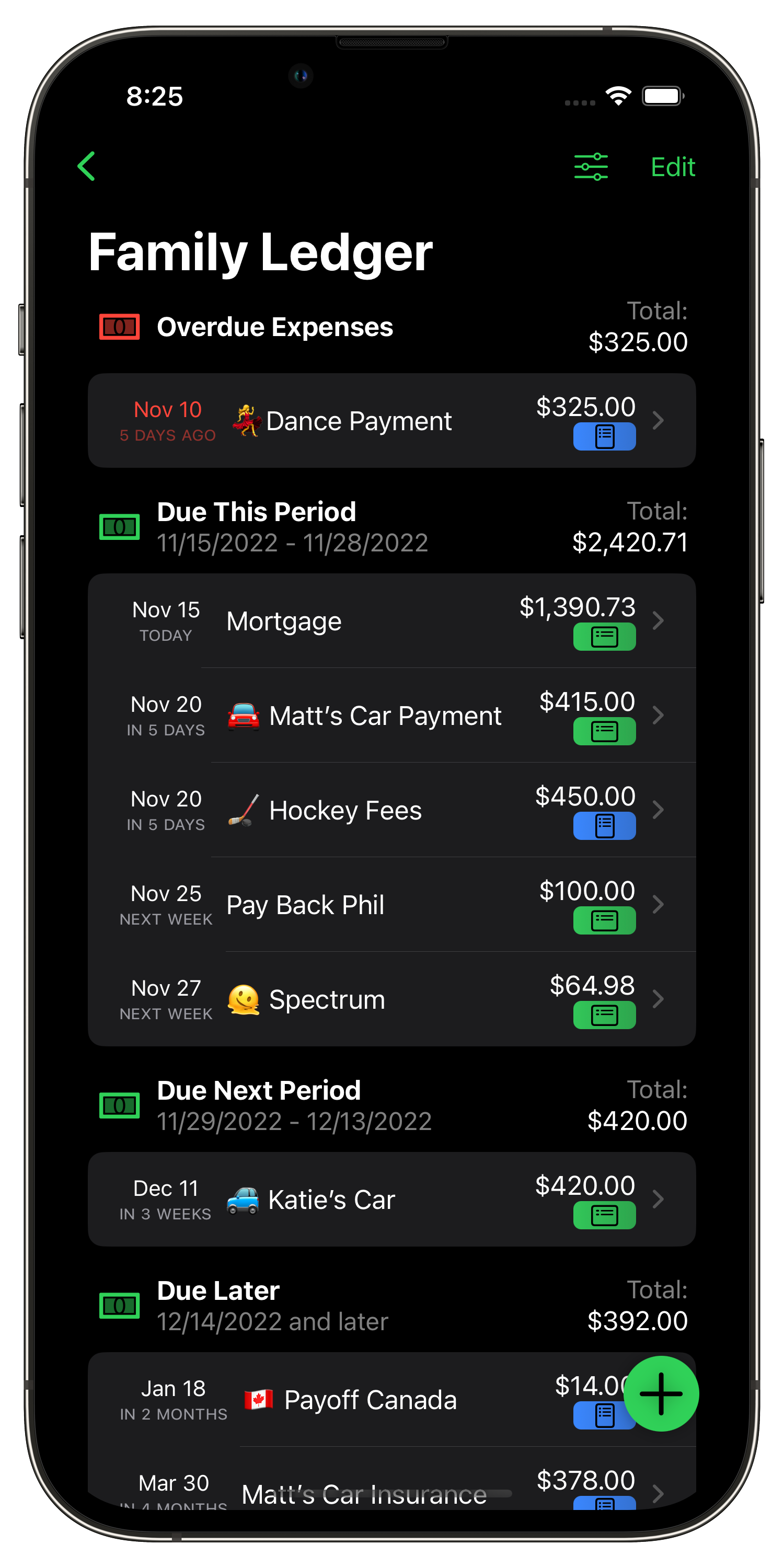

Bills to Budget is an iPhone, iPad and macOS app designed to help families budget for their weekly and monthly expenses without adding unwanted complication.

Bills to Budget is here to help:

Families who get to the end of the month and wonder how they spent their money.

Anyone who wants a better understanding of how much money their groceries, fast food, or other expenses really cost them.

Those who find it difficult to remember which bills need to be paid, when they need to be paid, and how much they will cost.

Families who have ever asked “Do we have enough to cover that big expense in four months?” or “Are we on track to save enough by the end of the year?”

How Bills to Budget helps

Getting to the end of the month — or even the middle of it! — and wondering where all your money went is something many of us have experienced. It’s no fun, but being able to make better spending decisions requires access to better information on what you’re spending money on and where you’re doing it. That’s where Bills to Budget really shines.

With Bills to Budget installed on their iPhone, iPad or Mac, families will:

Get their finances under control so they can make better decisions in the future.

Have a more rounded understanding of where their money goes every month.

All be on the same page, with Family Plus

Never pay a late fee because they forgot a payment again.

See trends in spending and saving with Account Insights, so they can understand not just what they owe, but how their financial habits are shaping up over time.

Plan ahead with Balance Forecasting, making sure they have enough to cover future expenses by factoring in income, bills, and savings.

Leverage the flexibility of comprehensive Shortcuts support for easier budgeting and expense recording.

Add due and paid bills as they come up or are paid, so nothing gets missed.

Enjoy iCloud syncing so budgeting information is always present and correct on multiple devices, and for all family members (with the Family Plus plan).

See their budgeting information at a glance with Home Screen widgets.

How does Bills to Budget do all of that?

Bills to Budget helps by offering easy-to-use features and a user flow that helps them become budgeting masters in no time. But we know that everyone has to start somewhere — that’s why Bills to Budget focuses on helping people keep track of their bills first, before moving on to more rounded budgeting.

At its core, Bills to Budget helps people get their finances under control by having them enter their monthly bill commitments and then setting up reminders to make sure there are no nasty surprises. By tracking not just what’s due but also how much money they have available, users can make smarter spending decisions.

People will always know how much they need to spend at any moment, removing the risk of unexpected bills. Once a bill is paid and marked as such, Bills to Budget resets, ready for next time. When next time actually is can be configured to suit any particular type of bill or payment plan too.

What’s more, if people tell Bills to Budget when they get paid, and how much their income is with each pay check, the app will make sure they’re aware of which payments will be due before their next funds become available, and will project how much they will have available for their spending budgets. That way nobody discovers if they are short when it’s already too late to do anything about it.

Beyond just tracking expenses, Account Insights gives users a clearer picture of their financial habits over time, helping them spot trends in spending and saving that can guide better financial decisions. Bills to Budget isn’t just about paying bills — it’s about understanding where money is going, staying ahead of future expenses, and building confidence in financial choices.

With Bills to Budget, people are always in control, fully aware of their financial situation and commitments in a way that empowers them to make better decisions about their money.

Pricing:

Bill Tracking - including the use of one Pay Schedule and one Account - is completely free.

The Bills to Budget Plus and Family Plus packages are available with three different pricing options:

Monthly subscription priced at:

$1.99 per month for Bills to Budget Plus, or

$4.99 per month for Family Plus (with a 3-day free trial)

Annual subscription priced at:

$19.99 per year ($9.99 for the first year) for Bills to Budget Plus, or

$29.99 per year ($19.99 for the first year) for Family Plus

A lifetime unlock priced at:

$34.99 for Bills to Budget Plus, or

$59.99 for Family Plus (upgrade pricing from Plus Lifetime to Family Plus Lifetime is available)

Contact information:

Website: https://www.billstobudget.com

App Store: https://apps.apple.com/us/app/bills-to-budget/id1636872963

Email: billstobudget@gmail.com

Bluesky: https://bsky.app/profile/billstobudget.com

Mastodon: https://indieapps.space/@BillsToBudget

Twitter: http://twitter.com/billstobudget